More than just a business account

All-in-one financial solution for Freelancers and SMEs

00

days

00

hrs

00

mins

00

secs

Get one month of our Smart Plan for €0

Sign up today and enjoy it for free

Users included:unlimited

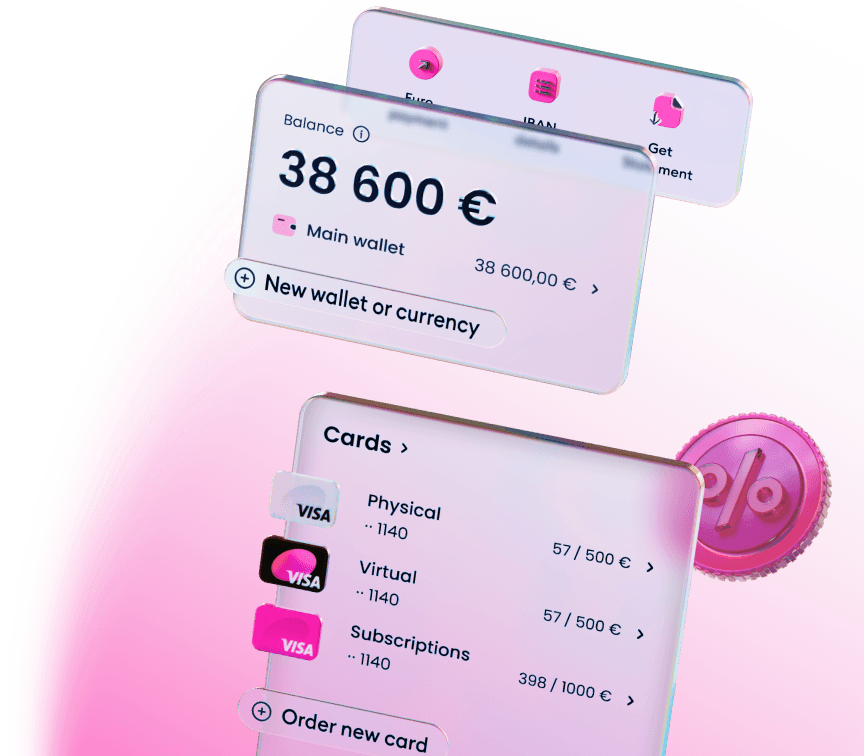

Wallets included:3

ATM withdrawal limit:€ 5 000

Card payment limit:€ 100 000

Virtual cards included:unlimited

Physical cards included:up to 3 per user

In/Out SEPA and Direct debit transfers:unlimited

Exchange money and transfer worldwide

3 times cheaper than at traditional banks

Customers love Finom

Free physical & virtual cards

Physical and instantly issued virtual cards for you and your team

Business account

For small businesses and freelancers

Team Management

Get personal and team expenses in control and keep your books tidy

Invoicing

Simple, powerful — built to get you paid twice as fast

Finom pricing and plans

Subscription plans at a fair cost tailored to fit your business.

For freelancers who need simple, essential features

You save € 48

For individual entrepreneurs and companies looking to scale their business

You save € 72

Save 20% with 6-month or annual plan

For growing businesses that need advanced features to manage their increasing operations

Business account

Business account

Business account

Users included

1

Users included

2

Users included

Cashback

0 %

Cashback

1 %

Cashback

3 %

AI Assistant

AI Assistant

AI Assistant

Chat support

Up to 1 business day

Chat support

Up to 3 hours

Chat support

Up to 3 minutes

Account Manager

Account Manager

Account Manager

Payment Solutions

Provided by Finom Payments

Payment Solutions

Provided by Finom Payments

Payment Solutions

Provided by Finom Payments

Personal IBAN (unique account number for global transfers)

Personal IBAN (unique account number for global transfers)

Personal IBAN (unique account number for global transfers)

Free outgoing SEPA transfers

€ 2.500

Free outgoing SEPA transfers

€ 25.000

Free outgoing SEPA transfers

€ 50.000

Free VISA physical cards per user

0

Free VISA physical cards per user

1

Free VISA physical cards per user

3

Free VISA virtual cards per user

1

Free VISA virtual cards per user

3

Free VISA virtual cards per user

10

Outgoing international transfers

1 %

Outgoing international transfers

0.50 %

Outgoing international transfers

0.40 %

Role and user management

Role and user management

Role and user management

Scheduled payments

Scheduled payments

Scheduled payments

Bulk payments

Bulk payments

Bulk payments

You save € 48

For individual entrepreneurs and companies looking to scale their business

You save € 72

Save 20% with 6-month or annual plan

For growing businesses that need advanced features to manage their increasing operations

You save € 360

For larger businesses requiring advanced features, higher limits, and greater flexibility

Business account

Business account

Business account

Users included

2

Users included

Users included

Cashback

1 %

Cashback

3 %

Cashback

unlimited cashback up to 0,5 %

AI Assistant

AI Assistant

AI Assistant

Chat support

Up to 3 hours

Chat support

Up to 3 minutes

Chat support

Up to 3 minutes

Account Manager

Account Manager

Account Manager

Account Management Team

Payment Solutions

Provided by Finom Payments

Payment Solutions

Provided by Finom Payments

Payment Solutions

Provided by Finom Payments

Personal IBAN (unique account number for global transfers)

Personal IBAN (unique account number for global transfers)

Personal IBAN (unique account number for global transfers)

Free outgoing SEPA transfers

€ 25.000

Free outgoing SEPA transfers

€ 50.000

Free outgoing SEPA transfers

€ 100.000

Free VISA physical cards per user

1

Free VISA physical cards per user

3

Free VISA physical cards per user

3

Free VISA virtual cards per user

3

Free VISA virtual cards per user

10

Free VISA virtual cards per user

Outgoing international transfers

0.50 %

Outgoing international transfers

0.40 %

Outgoing international transfers

0.20 %

Role and user management

Role and user management

Role and user management

Scheduled payments

Scheduled payments

Scheduled payments

Bulk payments

Bulk payments

Bulk payments

You save € 360

For larger businesses requiring advanced features, higher limits, and greater flexibility

You save € 1.080

The most comprehensive package, providing the fullest range of features for large-scale businesses to leverage all account capabilities

Business account

Business account

Users included

Users included

Cashback

unlimited cashback up to 0,5 %

Cashback

unlimited cashback up to 1 %

AI Assistant

AI Assistant

Chat support

Up to 3 minutes

Chat support

Up to 3 minutes

Account Manager

Account Management Team

Account Manager

Dedicated Account Manager

Payment Solutions

Provided by Finom Payments

Payment Solutions

Provided by Finom Payments

Personal IBAN (unique account number for global transfers)

Personal IBAN (unique account number for global transfers)

Free outgoing SEPA transfers

€ 100.000

Free outgoing SEPA transfers

Free VISA physical cards per user

3

Free VISA physical cards per user

3

Free VISA virtual cards per user

Free VISA virtual cards per user

Outgoing international transfers

0.20 %

Outgoing international transfers

0.10 %

Role and user management

Role and user management

Scheduled payments

Scheduled payments

Bulk payments

Bulk payments

Compare plans

All-in-one Business Platform

Solo

Save € 48

Basic

Save € 72

Smart

Business Account

Personal IBAN (unique account number for global transfers)

Multiaccounts

Cashback

0 %

1 %

3 %

Users included

1

2

Expense management

Team cards personalization

AI Assistant

Chat support

Up to 1 business day

Up to 3 hours

Up to 3 minutes

Email support

Up to 1 business day

Up to 3 hours

Up to 30 minutes

Weekend support

Account Manager

Provided by Finom Payments

SEPA Payments

Transfers between Finom's users in a few seconds

Extra SEPA OUT & Direct Debit transfers (per month)

0 € - 2500 €

0 %

0 %

0 %

2 500 € - 10000 €

0.30 %

0 %

0 %

10 000 € - 25 000 €

0.30 %

0 %

0 %

25 000 € - 50 000 €

0.30 %

0.03 %

0 %

50 000 € - 100 000 €

0.30 %

0.03 %

0.025 %

100 000 € +

0.30 %

0.03 %

0.025 %

SEPA Instant transfers

Decline of Direct Debit

5 €

5 €

5 €

Scheduled payments

Bulk payments

Card payments

Free physical cards

0

1 per user

3 per user

Physical card monthly maintenance

3 €

0

0

Monthly card payment limit

€100,000

€100,000

€100,000

Monthly ATM withdrawal limit

500 €

2000 €

5000 €

Card payments in foreign currency (non-EUR)

€ 0 - € 500

3 %

0 %

0 %

500 € - 1000 €

3 %

2 %

1 %

1000 €+

3 %

2 %

1 %

ATM withdrawals in foreign currency (non-EUR)

3 %

2 %

1 %

Card payments for certain MCCs (%, minimum 1 €)

€ 0 - € 500

3 %

2 %

1 %

500 € - 2500 €

4 %

3 %

2 %

2500 € - 5000 €

5 %

4 %

3 %

5000 €+

6 %

5 %

4 %

ATM withdrawal amounts (applicable for all cards)

€ 0 - € 500

1 %

0 %

0 %

€ 500 - € 2.000

3 %

1 %

0 %

2000 € - 5000 €

5 %

5 %

3 %

5000 € - 10 000 €

8 %

8 %

5 %

10 000 €+

8 %

8 %

8 %

Monthly fee for the inactive physical card

€0

€1

€0

Virtual cards

1 per user

3 per user

10 per user

Monthly fee for virtual VISA Card

0 €

0 €

0 €

Monthly fee for the inactive virtual card

1 €

0,5 €

0 €

Free card express delivery

Basic card limits management

Advanced card limits management

International payments

Incoming international payments (fee per payment)

5 €

5 €

5 €

Outgoing international payments (fee per payment)

5 €

5 €

5 €

Fee for the outgoing volume of international payments

1 %

0.50 %

0.40 %

Coverage of the International transfer cost, optional

35 €

35 €

35 €

Accounting & Invoicing

Accounting integrations up to 30 tools (Sage, NetSuite, Odoo, etc.)

Reconciliation of invoices and receipts

Recognition of invoices and receipts

Role and user management

Customization of invoice templates

Visual analytics of income and expenses

Additional fees for special services

Express delivery of Finom Card

15 €

15 €

Reference letter fee for business

80 €

80 €

80 €

Business Account Closure Refund Processing Fee

5 €

5 €

5 €

Recall of outgoing SEPA SCT

15 €

15 €

15 €

Inquiry on SEPA SCT (Payment Investigation)

15 €

15 €

15 €

Recall of international payments

60 €

60 €

60 €

Outgoing payment investigation

Incoming payment investigation

Fee for providing MT103

20 €

20 €

20 €

Fee for MT199 request

45 €

45 €

45 €

Audit confirmation statement

100 €

100 €

100 €

Refusal to redeem an authorized direct debit due to insufficient account balance

1 €

1 €

1 €

Unarranged negative balance on Finom Business Account

1 € per day

1 € per day

1 € per day

Dunning letter (per letter)

5 €

5 €

5 €

Card dispute for an authorised transaction (per transaction)

15 €

15 €

15 €

Administrating irregularities applied to the Finom Business Account

25 €

25 €

25 €

Personal account manager

Onboarding fee

Applied individually

Applied individually

Applied individually

Compliance fee

Please note that certain services are directly provided to you by a payment institution. Finom charges you for the platform services.

For our detailed price list, download PDF here

Save € 48

Basic

Save € 72

Smart

Save € 360

Pro

Business Account

Personal IBAN (unique account number for global transfers)

Multiaccounts

Cashback

1 %

3 %

unlimited cashback up to 0,5 %

Users included

2

Expense management

Team cards personalization

AI Assistant

Chat support

Up to 3 hours

Up to 3 minutes

Up to 3 minutes

Email support

Up to 3 hours

Up to 30 minutes

Up to 30 minutes

Weekend support

Account Manager

Account Management Team

Provided by Finom Payments

SEPA Payments

Transfers between Finom's users in a few seconds

Extra SEPA OUT & Direct Debit transfers (per month)

0 € - 2500 €

0 %

0 %

0 %

2 500 € - 10000 €

0 %

0 %

0 %

10 000 € - 25 000 €

0 %

0 %

0 %

25 000 € - 50 000 €

0.03 %

0 %

0 %

50 000 € - 100 000 €

0.03 %

0.025 %

0 %

100 000 € +

0.03 %

0.025 %

0.025 %

SEPA Instant transfers

Decline of Direct Debit

5 €

5 €

5 €

Scheduled payments

Bulk payments

Card payments

Free physical cards

1 per user

3 per user

3 per user

Physical card monthly maintenance

0

0

0

Monthly card payment limit

€100,000

€100,000

€100,000

Monthly ATM withdrawal limit

2000 €

5000 €

5000 €

Card payments in foreign currency (non-EUR)

€ 0 - € 500

0 %

0 %

0 %

500 € - 1000 €

2 %

1 %

1 %

1000 €+

2 %

1 %

1 %

ATM withdrawals in foreign currency (non-EUR)

2 %

1 %

1 %

Card payments for certain MCCs (%, minimum 1 €)

€ 0 - € 500

2 %

1 %

1 %

500 € - 2500 €

3 %

2 %

1 %

2500 € - 5000 €

4 %

3 %

2 %

5000 €+

5 %

4 %

3 %

ATM withdrawal amounts (applicable for all cards)

€ 0 - € 500

0 %

0 %

0 %

€ 500 - € 2.000

1 %

0 %

0 %

2000 € - 5000 €

5 %

3 %

3 %

5000 € - 10 000 €

8 %

5 %

5 %

10 000 €+

8 %

8 %

8 %

Monthly fee for the inactive physical card

€1

€0

€0

Virtual cards

3 per user

10 per user

Monthly fee for virtual VISA Card

0 €

0 €

€ 0

Monthly fee for the inactive virtual card

0,5 €

0 €

0 €

Free card express delivery

Basic card limits management

Advanced card limits management

International payments

Incoming international payments (fee per payment)

5 €

5 €

5 €

Outgoing international payments (fee per payment)

5 €

5 €

5 €

Fee for the outgoing volume of international payments

0.50 %

0.40 %

0.20 %

Coverage of the International transfer cost, optional

35 €

35 €

35 €

Accounting & Invoicing

Accounting integrations up to 30 tools (Sage, NetSuite, Odoo, etc.)

Reconciliation of invoices and receipts

Recognition of invoices and receipts

Role and user management

Customization of invoice templates

Visual analytics of income and expenses

Additional fees for special services

Express delivery of Finom Card

15 €

Reference letter fee for business

80 €

80 €

€ 80

Business Account Closure Refund Processing Fee

5 €

5 €

€ 5

Recall of outgoing SEPA SCT

15 €

15 €

€ 15

Inquiry on SEPA SCT (Payment Investigation)

15 €

15 €

€ 15

Recall of international payments

60 €

60 €

€ 60

Outgoing payment investigation

€ 45

Incoming payment investigation

€ 50

Fee for providing MT103

20 €

20 €

€ 20

Fee for MT199 request

45 €

45 €

€ 45

Audit confirmation statement

100 €

100 €

€ 100

Refusal to redeem an authorized direct debit due to insufficient account balance

1 €

1 €

1 €

Unarranged negative balance on Finom Business Account

1 € per day

1 € per day

€ 1 per day

Dunning letter (per letter)

5 €

5 €

€ 5

Card dispute for an authorised transaction (per transaction)

15 €

15 €

€ 30

Administrating irregularities applied to the Finom Business Account

25 €

25 €

€ 25

Personal account manager

Onboarding fee

Applied individually

Applied individually

Applied individually

Compliance fee

Applied individually

Please note that certain services are directly provided to you by a payment institution. Finom charges you for the platform services.

For our detailed price list, download PDF here

Save € 360

Pro

Save € 1.080

Grow

Business Account

Personal IBAN (unique account number for global transfers)

Multiaccounts

Cashback

unlimited cashback up to 0,5 %

unlimited cashback up to 1 %

Users included

Expense management

Team cards personalization

AI Assistant

Chat support

Up to 3 minutes

Up to 3 minutes

Email support

Up to 30 minutes

Up to 30 minutes

Weekend support

Account Manager

Account Management Team

Dedicated Account Manager

Provided by Finom Payments

SEPA Payments

Transfers between Finom's users in a few seconds

Extra SEPA OUT & Direct Debit transfers (per month)

0 € - 2500 €

0 %

0 %

2 500 € - 10000 €

0 %

0 %

10 000 € - 25 000 €

0 %

0 %

25 000 € - 50 000 €

0 %

0 %

50 000 € - 100 000 €

0 %

0 %

100 000 € +

0.025 %

0 %

SEPA Instant transfers

Decline of Direct Debit

5 €

5 €

Scheduled payments

Bulk payments

Card payments

Free physical cards

3 per user

3 per user

Physical card monthly maintenance

0

0

Monthly card payment limit

€100,000

€100,000

Monthly ATM withdrawal limit

5000 €

5000 €

Card payments in foreign currency (non-EUR)

€ 0 - € 500

0 %

0 %

500 € - 1000 €

1 %

1 %

1000 €+

1 %

1 %

ATM withdrawals in foreign currency (non-EUR)

1 %

1 %

Card payments for certain MCCs (%, minimum 1 €)

€ 0 - € 500

1 %

1 %

500 € - 2500 €

1 %

1 %

2500 € - 5000 €

2 %

2 %

5000 €+

3 %

3 %

ATM withdrawal amounts (applicable for all cards)

€ 0 - € 500

0 %

0 %

€ 500 - € 2.000

0 %

0 %

2000 € - 5000 €

3 %

3 %

5000 € - 10 000 €

5 %

5 %

10 000 €+

8 %

8 %

Monthly fee for the inactive physical card

€0

€0

Virtual cards

Monthly fee for virtual VISA Card

€ 0

€ 0

Monthly fee for the inactive virtual card

0 €

0 €

Free card express delivery

Basic card limits management

Advanced card limits management

International payments

Incoming international payments (fee per payment)

5 €

5 €

Outgoing international payments (fee per payment)

5 €

5 €

Fee for the outgoing volume of international payments

0.20 %

0.10 %

Coverage of the International transfer cost, optional

35 €

35 €

Accounting & Invoicing

Accounting integrations up to 30 tools (Sage, NetSuite, Odoo, etc.)

Reconciliation of invoices and receipts

Recognition of invoices and receipts

Role and user management

Customization of invoice templates

Visual analytics of income and expenses

Additional fees for special services

Express delivery of Finom Card

Reference letter fee for business

€ 80

€ 80

Business Account Closure Refund Processing Fee

€ 5

€ 5

Recall of outgoing SEPA SCT

€ 15

€ 15

Inquiry on SEPA SCT (Payment Investigation)

€ 15

€ 15

Recall of international payments

€ 60

€ 60

Outgoing payment investigation

€ 45

€ 45

Incoming payment investigation

€ 50

€ 50

Fee for providing MT103

€ 20

€ 20

Fee for MT199 request

€ 45

€ 45

Audit confirmation statement

€ 100

€ 100

Refusal to redeem an authorized direct debit due to insufficient account balance

1 €

1 €

Unarranged negative balance on Finom Business Account

€ 1 per day

€ 1 per day

Dunning letter (per letter)

€ 5

€ 5

Card dispute for an authorised transaction (per transaction)

€ 30

€ 30

Administrating irregularities applied to the Finom Business Account

€ 25

€ 25

Personal account manager

Onboarding fee

Applied individually

Applied individually

Compliance fee

Applied individually

Applied individually

Please note that certain services are directly provided to you by a payment institution. Finom charges you for the platform services.

For our detailed price list, download PDF here

Meet our 100,000+ customers

Read real, authentic reviews

Security is our top priority

GDPR Compliance

Our servers are protected and hosted in the European Union

Reliable partners

To minimize risks, we’ve partnered with one of the largest multinational banks, BNP Paribas, to hold your funds

Safeguarded funds: unlimited

We have a separate Safeguarding Foundation supervised by the DNB to manage your money

Passkeys and 3D Secure

Your money is protected with secure passwordless authentication and single-use passwords

Customer support, providing real-time care

Help is just a click away

Interactive Help Center available 24 hours

Fast response time

Contact us on e-mail: [email protected]

FAQ

What is Finom?

Finom is a European fintech company built for entrepreneurs and small to medium-sized enterprises. We believe that small businesses are the foundation of the European economy, so our goal is to simplify the lives of those who provide for half of Europe. We came to bring the technologies of the future to business management processes for entrepreneurs, enabling them to spend their resources where it matters the most: on their businesses and themselves. That’s why we combined all these different financial services, such as accounting, financial management, and a business account, into one convenient solution. Early-stage businesses can sign up for an online account within minutes and immediately enjoy our features’ advantages via our mobile and web apps.How safe is my money with Finom?

Your money is in safe hands because we strive to provide a high level of security to protect it: - With cutting-edge measures such as Passkeys and the added shield of 3D Secure, confidence accompanies every transaction. - Your account is exclusively linked to your smartphone, providing an additional layer of protection, while real-time push notifications keep you informed of all account activity. - Harnessing the power of artificial intelligence and machine learning, our platform is fortified to safeguard your account against financial crime and card fraud. - The app allows you to customize security to your preferences: you can instantly block or freeze your cards, modify your PIN, and set up spending limits and access controls. In addition to the security measures on the Finom platform and applications, there are also legal regulatory measures of the institution providing your business account, i.e. Safeguarding your account via Finom Payments B.V.: - When you add money to your Finom account or receive payments, we ensure that the equivalent value of electronic money is placed in your account. - It’s important to note that your Finom payment account isn’t a deposit account, which means we can’t pay you interest due to legal restrictions. But rest assured, we keep your money safe and never lend it to anyone else. - We’ve established a separate Safeguarding Foundation, supervised by the DNB, to manage your money as safeguarded customer funds. - We’ve partnered with reliable European banks like BNP Paribas to hold your funds. BNP Paribas is one of the largest banking groups in Europe, minimizing any risk. - Even in unlikely scenarios, such as Finom or BNP Paribas facing bankruptcy, your safeguarded customer funds remain protected. They are not accessible to Finom’s creditors and would be returned to you under the supervision of the DNB. Please note that PNL Fintech B.V. (Finom) does not provide or guarantee these deposit protection methods. For more information, please refer to the Terms of Finom Payments.Is my data safe with Finom?

Finom protects your data and guarantees the highest level of security: Finom has no access to your online banking credentials, and they are double-encrypted (for additional protection) using passkeys or a one-time password that must be entered each time you try to log in). All data transfers are transmitted over TLS-encrypted channels and are thereby protected via end-to-end encryption. We do not store your personal data against your will or without your explicit consent, Finom is GDPR (DSGVO for Germany and RGPD for France) compliant, which means that you can revoke your consent to the processing of your personal data at any time. Finom Privacy Policy regulates the processing of your personal data.How does a Finom business account differ from a traditional bank account?

Finom is a fintech company and NOT a bank. Finom allows you to access some services associated with traditional banking, such as payments, withdrawals, and cards, but in the fastest and smartest way. With Finom, you can set up a business account in a few seconds, check your balance on the go, get cashback of up to 3%, create and send invoices, rely on real-time customer support, delegate tasks to team members, monitor your expenses and incomes, and have them categorized according to your habits.Under which license does Finom operate?

Finom Payments BV (Finom) is a licensed electronic money institution authorized by the Dutch Central Bank, De Nederlandsche Bank (DNB), to operate in the European Union (EU) and the European Economic Area (EEA).What documents do I need to open an account?

Whether you are a freelancer or own a company, opening your Finom business account only takes a few minutes. You will only need three things for it: - The email address and password you used for the pre-registration (if you forgot them, click 'forgot password'); - Your ID or passport ready to verify your identity; - All the information about your business.Can entrepreneurs from any country open an account?

Currently, we open business accounts for companies based in and operating from Germany, France, Italy, the Netherlands, Belgium, and Spain. Our invoicing plan is available in Poland, while freelancer and customized corporate tariffs can be picked by any of the EEA countries’ entrepreneurs. The legal representative (the sole individual authorized to open a business account on behalf of a company) and the beneficial owners must possess a valid residence permit in one of the mentioned countries, irrespective of the country where their passport/ID card is issued. Additionally, we welcome applications from US residents and citizens establishing businesses in the EU.As a US citizen, can I open an account for my business operating in the EU, and is FATCA compliance required?

Yes, US citizens are eligible to open a Finom business account for their enterprises established in the EU. Unlike traditional banks, Finom, as a licensed electronic money institution authorized to operate in the European Union (EU) and the European Economic Area (EEA), doesn’t require FATCA (Foreign Account Tax Compliance Act) compliance for opening accounts. We strive to provide financial services to all individuals legally running their businesses in the EU, ensuring compliance with relevant regulations governing our operations. Therefore, US citizens can confidently engage with our platform without needing FATCA documentation.How can I withdraw funds from my account or make deposits into it?

A Finom Business Account has all the main services of a traditional bank, such as making withdrawals from the account and depositing funds into it. You can use a SEPA transfer from your other bank account to deposit into an account. To withdraw, you can use your physical Finom card at any European ATM, free amount to withdraw per month depends on your chosen plan.Can I make SEPA and international transfers with Finom (like SWIFT or similar)?

Yes, Finom allows you to send payments within the SEPA zone as well as international payments worldwide.Does your support team speak my language?

Of course! Our customer care team speaks all the languages of the countries we cover, like German, French, Dutch, Italian, Spanish, Polish, and more. And yes, English too, of course. So, language won’t be a barrier when you need assistance.

Get your AI business transformation roadmap

From automation to cost optimization, discover how to use AI today. Download our free expert guide with real case studies and actionable insights.